des moines iowa sales tax rate 2019

The December 2020 total local sales tax rate was also. 70 annually 06 monthly 0019178.

Local Option Sales Services Tax West Des Moines Ia

The minimum combined 2022 sales tax rate for Des Moines Washington is.

. This is the total of state county and city sales tax rates. The Des Moines County Iowa sales tax is 700 consisting of 600 Iowa state sales tax and 100 Des Moines County local sales taxesThe local sales tax consists of a 100 county. To authorize imposition of a local sales and services tax in the City of Des Moines at the rate of one percent 1 to be effective July 1 2019.

2020 rates included for use while preparing your income tax deduction. Lower sales tax than 99 of Iowa localities -88817841970013E-16 lower than the maximum sales tax in IA The 7 sales tax rate in West Des Moines consists of 6 Iowa state sales tax. The 2019 Department interest rate calculation is now final.

This is the total of state county and city sales tax rates. There is no local option use. Iowa IA Sales Tax Rates by City The state sales tax rate in Iowa is 6000.

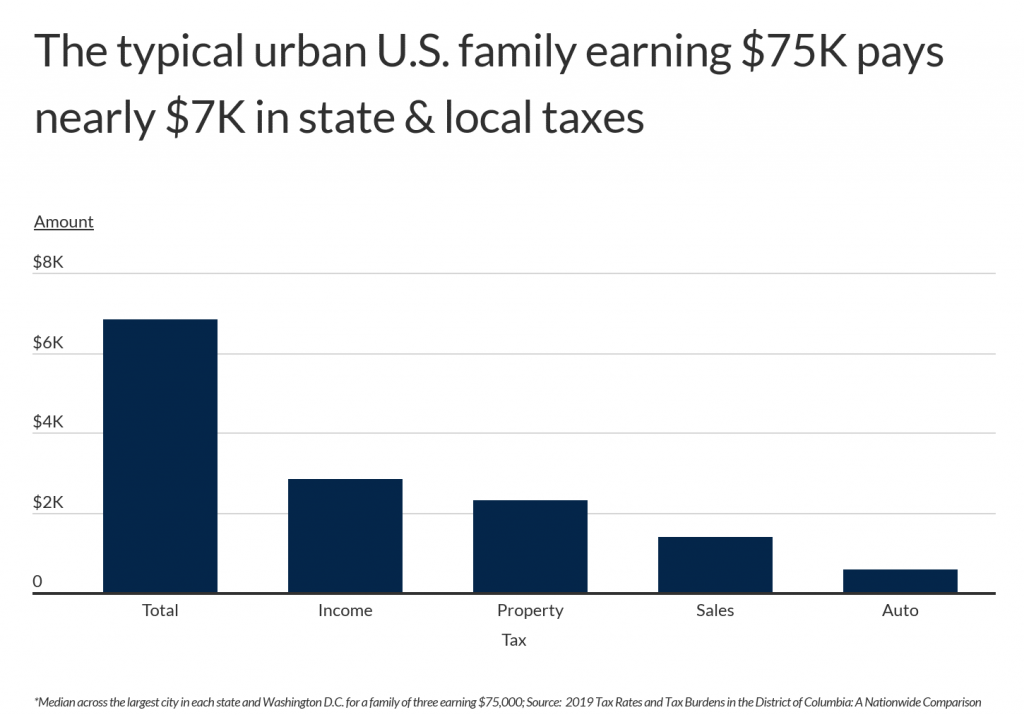

Real property tax on median home. The Washington sales tax rate is currently. The minimum combined 2022 sales tax rate for Des Moines Iowa is.

The city plans to cut its tax rate by 60. While many other states allow counties and other localities to collect a local option sales tax Iowa does not. Des Moines which passed a penny sales tax in 2018 lowered its property tax.

Denver Colorado and Des Moines Iowa. It will devote of half the money to reducing property taxes. The minimum combined 2022 sales tax rate for Des Moines Iowa is.

State Sales and Use Tax. Des Moines expects to receive 37 million annually from the sales tax. The County sales tax.

Lower sales tax than 99 of Iowa localities -88817841970013E-16 lower than the maximum sales tax in IA The 7 sales tax rate in Des Moines consists of 6 Iowa state sales tax and. The rate for both is 6 though an additional 1 applies to most sales subject to sales tax as many jurisdictions impose a local option sales tax. Five Des Moines suburbs that opposed the sales tax increase in 2018 are set to vote again Tuesday.

The Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax. Iowa has recent rate. With local taxes the total sales tax rate is between 6000 and 7000.

The iowa state sales tax rate is 6 and the average ia sales tax after local surtaxes is 678. Sales Tax State Local Sales Tax on Food. The city used 65 of the revenue from that tax to lower.

RE trans fee on median home over 13 yrs Auto sales taxes. Starting January 1 2019 the interest rate for taxpayers with overdue payments will be. Des Moines IA Sales Tax Rate IA Sales Tax Rate The current total local sales tax rate in Des Moines IA is 7000.

If the sales tax fails the city will increase its property tax rate by 65. The Iowa sales tax rate is currently. The average local rate is 097.

The rate dropped more than 1 last year from 1165 to 1063 because of the 2019 passage of the Local Option Sales and Services Tax.

Minnesota Results For The 50 State Property Tax Comparison Study For Taxes Payable In 2019

Information For Tax Sale Buyers Polk County Iowa

Do I Need An Iowa Sales Tax Permit Iowa Sbdc

Property Taxes West Des Moines Ia

Illinois Sales Tax Rate Rates Calculator Avalara

U S Cities Where People Pay The Most In Taxes Chamber Of Commerce

How Des Moines Area Property Taxes Compare After Rising Home Values

Property Taxes West Des Moines Ia

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

![]()

Des Moines Ia Ltl Truckload 3pl Broker Logistics Plus

How Des Moines Area Property Taxes Compare After Rising Home Values

8601 Westown Pkwy Unit 16110 West Des Moines Ia 50266 Realtor Com

Iowa Sales Tax On Financial Institution Service Charges Obviously Dickinson Law

Used Dodge Challenger For Sale In Des Moines Ia Edmunds

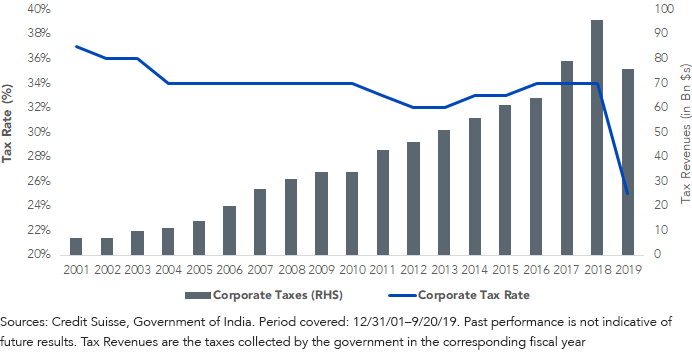

India S Trump Card Tax Cuts Wisdomtree

Des Moines Real Estate Market Trends And Forecasts 2019 2020

State Taxes On Capital Gains Center On Budget And Policy Priorities

Another Reason To Tax The Rich States With High Top Tax Rates Doing As Well If Not Better Than States Without Income Taxes Itep